DATAMATH CALCULATOR MUSEUM

|

DATAMATH CALCULATOR MUSEUM |

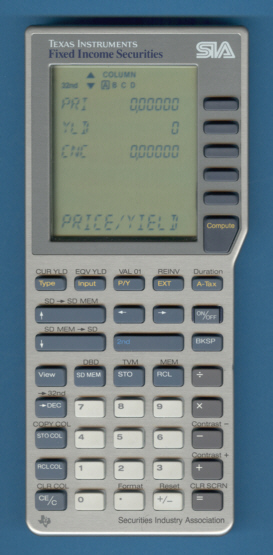

Texas Instruments Fixed Income Securities SIA

| Date of introduction: | 1989 | Display technology: | LCD multi segment |

| New price: | Display size: | 3+12 * 6 lines | |

| Size: | 6.9" x 3.1" x 0.65" 174 x 78 x 17 mm3 |

||

| Weight: | 6.1 ounces, 172 grams | Serial No: | 40191 |

| Batteries: | 2*CR2032 | Date of manufacture: | wk 26 year 1989 |

| AC-Adapter: | Origin of manufacture: | Italy | |

| Precision: | 13 | Integrated circuits: | TMC70035, LH5821, LH5164, TC54256 |

| Memories: | 10 | ||

| Program steps: | Courtesy of: | Joerg Woerner |

![]()

This

Fixed Income Securities (FIS) calculator introduced by Texas Instruments in 1989

looks at first glance identical to the Financial Investment Analyst FIA-10.

A closer look at the twins reveals different labeling of the keys and a

promising logo SIA.

This

Fixed Income Securities (FIS) calculator introduced by Texas Instruments in 1989

looks at first glance identical to the Financial Investment Analyst FIA-10.

A closer look at the twins reveals different labeling of the keys and a

promising logo SIA.

Both the FIA-10 and FIS calculators share an identical user interface based on worksheets using the huge, alphanumerical display and separate function keys. Compared with the previous Business Analyst BA-II and the later BA II PLUS Advanced Business Analyst great difference. In most calculations all results and variables are visible simultaneously and like a spreadsheet on the personal computer you can change one value and observe the new results.

While the FIA-10 was developed as a standard financial calculator centered around "Time Value of Money", "Cash Flow" and "Bond Calculations" worksheets, focuses this FIS calculator obviously on fixed-income securities.

Dismantling

the Fixed Income Securities calculator reveals a printed circuit board (PCB)

known already from the FIA-10 with some minor modifications. The hardware is based on a 8-bit

TMS7000

microcomputer supported by a 8k*8 RAM (Sharp LH5164), 32k*8 OTP-EPROM (Toshiba

TC54256) and an

LCD-controller (Sharp LH5821). The main differences to the FIA-10 are the size of the

RAM (2k*8 vs. 8k*8) and obviously the program stored in the EPROM.

Dismantling

the Fixed Income Securities calculator reveals a printed circuit board (PCB)

known already from the FIA-10 with some minor modifications. The hardware is based on a 8-bit

TMS7000

microcomputer supported by a 8k*8 RAM (Sharp LH5164), 32k*8 OTP-EPROM (Toshiba

TC54256) and an

LCD-controller (Sharp LH5821). The main differences to the FIA-10 are the size of the

RAM (2k*8 vs. 8k*8) and obviously the program stored in the EPROM.

Don't miss an early prototype of the Fixed

Income Securities calculator manufactured in March 1989 but hosting software

tested in May 1989.

The software of the Fixed Income Securities supports 4 different worksheets to

solve specific types of problems:

| WS | Title and function of the worksheet |

| #1 | Securities Worksheet

Calculates dollar price “to maturity”, dollar price “to call”, yield to maturity, and yield to call, with concessions for all bonds, notes, gain/step, and perpetual securities to SIA standards. Calculates dollar price, discount rate, yield, and bond equivalent yields for Treasury bills and all discount securities to SIA standards. Calculates extensions for all securities to SIA standards. Includes settings for issue code, security type, coupon frequency, day-count method, and end-of-month coupon rule which allow for calculations of many international securities. Allows you to perform four separate bond calculations for comparison. You can also store column information for up to 20 securities in a separate column storage area. |

| #2 | The Time Value of Money worksheet gives you the capability to do time-value-of-money calculations and generate an amortization schedule. |

| #3 | The Date Calculation worksheet finds the number of days between two dates, or finds a date that is a specified number of days from a given date. |

| #4 | The Memory worksheet provides a visible storage area for as many as 10 values. You can display five of the values at a time. |

Securities Industry Association (SIA) was established in 1972 through the

merger of the Association of Stock Exchange Firms (1913) and the Investment Banker's Association (1912).

The Securities Industry Association brings together the shared interests of more than

740 securities firms to accomplish common goals. SIA member-firms (including investment

banks, broker-dealers, and mutual fund companies) are active in all U.S. and foreign markets and in all phases of corporate and public

finance.

The U.S. securities industry manages the accounts of more than 50-million investors

directly and tens of millions of investors indirectly through corporate, thrift, and pension

plans. The industry generates more than $300 billion of revenues yearly in the U.S.

economy and employs approximately 700,000 individuals.

Reprinted from

the SIA website, New York, NY.

If you have additions to the above article please email: joerg@datamath.org.

© Joerg Woerner, December 19, 2006. No reprints without written permission.